By encouraging customers to pay, you easily increase your company's cash flow, improve your collection rate, and reduce collection costs. Below are the key benefits of SMS communication for debt collection.

- 99% open rate: 93% of smartphone users always have their cell phone within reach, and 99% of these read their messages immediately when they arrive.

- Increased response rates: When it comes to debt collection, getting a response from customers is key. Many customers refuse to answer calls or emails but do respond to text messages.

- Free up significant funds: Traditional debt collection methods will erode your company's budget. Automated text solutions are cost-effective.

- Reach all customers immediately: Reach all your customers immediately by sending SMS messages. You can also enable receipts to identify deregistered numbers or failed deliveries.

- Improve the relationship with your customers: Debt collection is stressful for both your business and the customer. Who knows what unfortunate circumstances may have led to a missed payment? Text messages offer a non-invasive means of communication that won't jeopardize your relationships with customers.

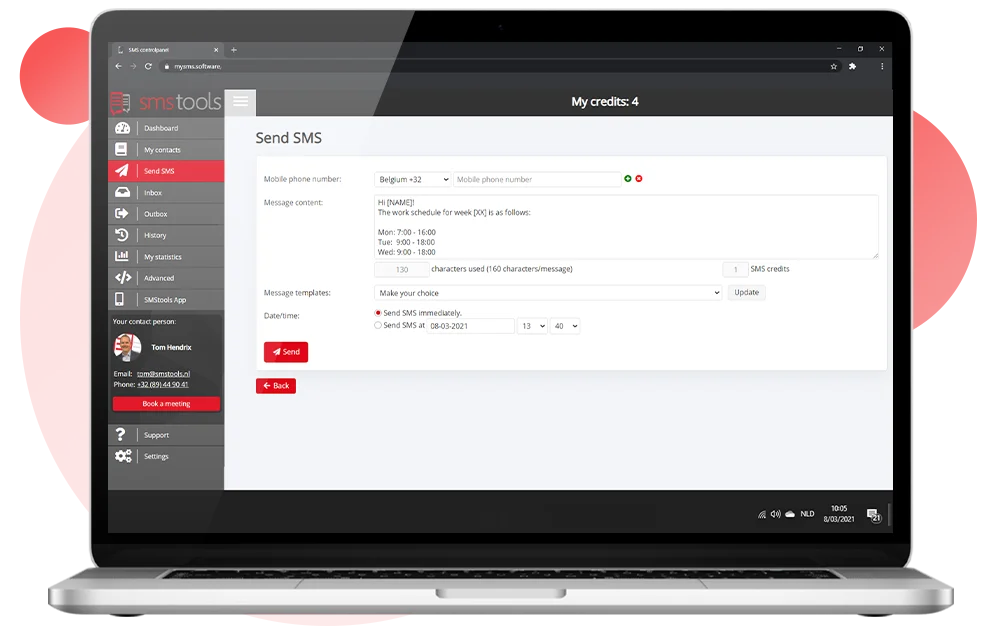

- Save Time: You can save a lot of time collecting via text messages by making full use of automated software and message templates. For example, you can use one template to send a list of contacts a unique message.

- Create a sense of urgency: Text reminders create a sense of urgency that reinforces the importance of timely payments. Be sure to include due dates and other useful information to convince customers to complete on time.

Useful SMS templates for debt collection

Check out our SMS templates for debt collection messages that replicate the official emails from debt collection agencies and tell us what you think. The elements between '[]' are replaced by personal elements.

1. Notification

"Dear [CUSTOMER], we would like to remind you that the amount of [AMOUNT] was due on [DATE]. Please make the payment no later than [VALID DATE] to avoid further charges."

2nd Reminder

"Dear [CUSTOMER], we have not yet received the amount of [AMOUNT] that was due on [DATE]. If your payment is not received within 7 days, we will take legal action. We urge you to make payment."

3. Final Reminder

"Dear [CUSTOMER], despite our previous reminders, we still have not received payment. We regret to inform you that we are forced to take legal action to recover the debt."

4. Informing the debtor about legal action

"Dear [CUSTOMER], because you have not paid the debt of [AMOUNT], we have referred your case to court. You will be informed of the date of the hearing by an official lawyer.

5. Thank You Message

"Dear [CUSTOMER], your payment of [AMOUNT] has been accepted. Your debt has been settled. Thank you!"

Text message collection has many benefits. If you are ready to implement these strategies for your business, feel free to contact us. We'd be happy to help you out!

Start debt collecting SMS today and get 5 free test credits!

REGISTER

7 benefits of SMS marketing for bailiffs and debt collection agencies